Financial clarity that meets you where you are.

My Role:

Product Designer

Timeframe:

15 weeks

Tools:

FigJam, Figma, Maze

It’s about knowing where it’s going.

What changed this month?

Why did your spending jump?

And what even is that mystery transaction from last Friday?

The problem isn’t your spending.

It’s the lack of visibility.

THE CHALLENGE

You have the apps. You track your expenses.

But somehow, you still ask yourself:

“Where did all my money go?”

It’s not about being careless.

It’s about how invisible financial habits — like auto-renewed subscriptions, unexpected charges, and shifting spending patterns — sneak up on you.

How can I help everyday users better understand their spending, catch hidden charges, and make smarter financial choices — without adding more work to their routine?

SOLUTION

Bringing Clarity to Everyday Finances

Managing finances is tough with unpredictable spending and hidden subscriptions. This AI-powered solution with a subscription tracker helps users monitor spending, manage recurring payments, and get personalized recommendations for better financial control.

Meet Reggie, Reveal’s AI bot helping user understand transaction details and more…

Financial Insight with multiple widgets giving detailed information into user spending

Detailed insights to understand spending spikes and easy dispute of transactions

1. RESEARCH

I conducted interviews to explore how people respond to credit card bills and transactional information — uncovering both the emotional and practical challenges they face, and understanding how their expectations around financial clarity could shape a better experience.

Organizing the notes, quotes, and data from our research through affinity mapping.

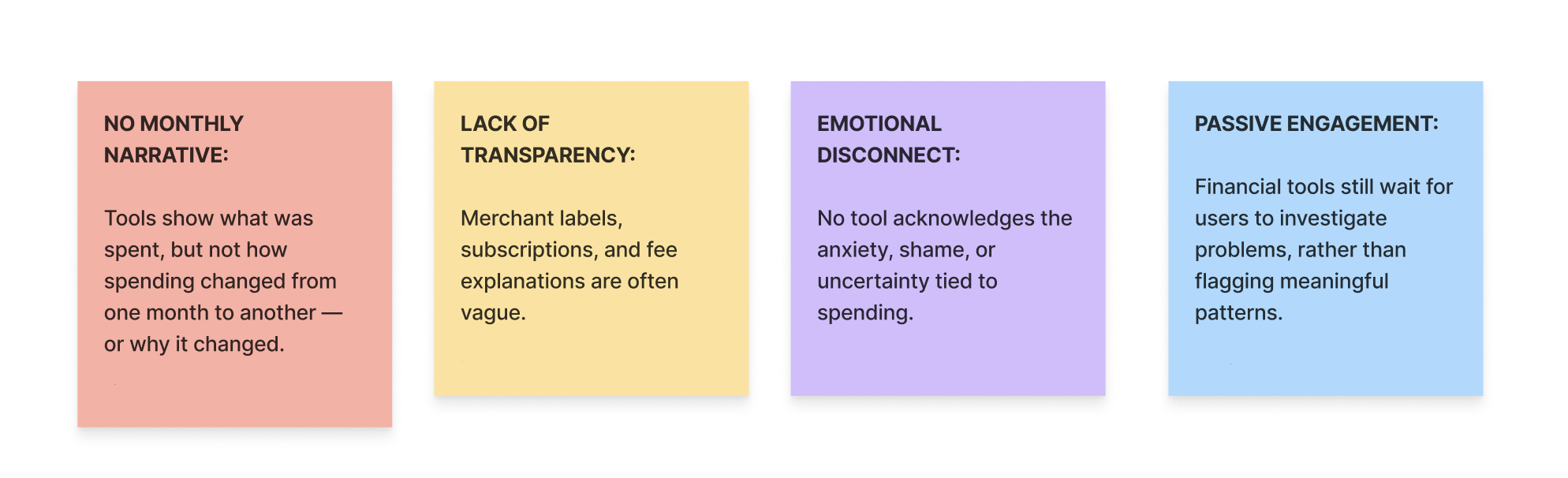

So, what’s really broken?🤔

It’s the presentation of financial data — not personal, not proactive, not human.

Users feel overwhelmed by the unclear nature of transaction statements and want to regain control of their finances, without relying on external tools.

2. UNDERSTANDING THE MARKET

WHAT DO THEY MISS

We analysed Apple Wallet, American Express, Chase, Rocket Money, Capitol One and Monarch Money. Across all these tools, key gaps remain:

3. OPPORTUNITY

Grounded in both user insights and competitive gaps, Reveal can lead a product that provides context and clarity for each transaction, offers dynamic data visualizations to enhance users' understanding of their spending, and helps them identify and manage subscriptions and recurring charges.

| The market gives users data. Reveal will give them clarity and control

| While existing tools help users see what they spent, Reveal will help them understand what changed, and why it matters.

4. MVP IDEATION

Driven by user pain points and gaps in the market, our feature ideation focused on bringing clarity, control, and emotional ease — Prompting us to ask:

How might we help users access the most pertinent information about their monthly bill in a reliable and trustworthy way?

How might we help users better understand their credit card bills and afford them the ability to control and personalize the experience?

❤️ What users loved?

We tested lightweight ideas from our roadmap with users — and got powerful feedback:

One-swipe monthly summaries that explain changes

Subscription alertsbefore they’re charged

Gentle reminders — not dashboards

Small moments of reassurance: “You’re still within your usual range”

🤔 What could change?

Manual setup

Charts they had to interpret

Notifications that felt like scolding

Tagging unless it was passive or effortless

Users don’t want to analyze their money — they want to understand it at a glance, feel in control, and get on with their day.

What else is being done in the market that we haven't thought about?

So we paused.

And decided to validate our direction before building further.

Why AMEX Banking App?

We chose the AMEX banking app as the foundation for Reveal to add a modern, intelligent layer to traditional banking. Rather than creating a separate B2C product, integrating these features directly into the AMEX ecosystem ensures a more seamless and accessible experience for users.

Reveal isn’t just an insight engine.

It’s a human layer for credit card experiences — one that fits within the AMEX app and makes the complex feel calm.

USER FLOW

MID-FI WIREFRAMES

DESIGN SYSTEM

Reveal is no longer just solving usability problems. Is helping people feel informed, supported, and in control of their money — without ever overwhelming them.

Logos

Chat Bubbles

Buttons

Color Palette

Navigation Bar

Icons

Emojis

Health Tracker

Charts

Logos

Trend indicators

INITIAL PROTOTYPE

V1

SUBSCRIPTION MANAGEMENT AND BLOCKING

TRANSACTION CLARITY USING REGGIE (REVEAL’s AI BOT)

V2

Users wanted clearer insights—like fraud detection or overspending reasons—ideally on a dedicated page, with some suggesting a forecast based on past spending.

V2

Users wanted a smoother cancellation experience and felt frustrated by unclear post-blocking steps—early communication of these limitations could boost trust and satisfaction.

Instead, we placed the AI assistant below the transaction details with a brief prompt to clearly signal that users can get help from Reveal’s AI bot.

Users were confused by the term “block” and the need to cancel subscriptions separately, leading to hesitation—though the CTA remained easy to find and use.

The floating action button (FAB) had mixed recognition: 60% of users understood its purpose, while 40% did not.

5. USABILITY TESTING

V2

Users struggled to navigate the chatbot due to unclear chart interactions, overwhelming info, and small visuals that made key insights—like spending increases and category details—hard to understand.

The usability test focused on evaluating how easily users could navigate financial insights, manage subscriptions, and interact with the AI chatbot for support and clarity.

EXPLORING DINING INSIGHTS AND SPENDING

V1

V1

Leading beyond design strengthened my adaptability – Co-leading the project and handling responsibilities outside of product design taught me how to manage timelines, coordinate tasks, and make decisions confidently.

Empathy is essential in financial design – I developed a deeper awareness of how emotionally complex money management can be, which helped me create more thoughtful and supportive user experiences.

Clarity and context build trust – I learned that users respond better when features are clearly explained and placed where they naturally expect them.

Good communication drives progress – Regular updates, clear documentation, and open discussions helped maintain momentum and ensure everyone stayed on the same page.

6. FINAL PROTOTYPE

WHAT I LEARNED?